Look at me now look at me now look at me look at me look at me now no one can bother me not in the slightest i'm yelling victory throwing your towel i'm taking my shot and doing it well i'm saving myself no need for the bell i'm giving it everything all that i got i'm conquering battles they're raging my thoughts so i take one step at a time fall into formation as i see the motivation in the eyes of my reflection you may reap what you sow but i'm gonna reap what i write i put in the work and i do it a lot cause you gonna see me when i'm at the top is fun picked a random truck in the motor pool that looked like it needed a lot of work i went line by line from the tm conducting the checks and annotating all the deficiencies the tm may not be perfect but it's absolutely required to fill out the da form 5988 correctly get all the parts ordered with less delays and it also prevents you from forgetting anything and reminds us to check the ar 385-10 to ensure that the deficiency isn't a safety deadline even if it isn't a hard deadline by the column and the tm let's go over the findings and how i came to get the item numbers and describe the deficiencies all of the information about filling out the da4598 and the da2404 come from the da pam 750-8 and some out of the ar 750-1 keep in mind that regardless of what's said in this video follow all your local sops and command policies don't quote me and have your maintenance chief looking me up on global to send...

PDF editing your way

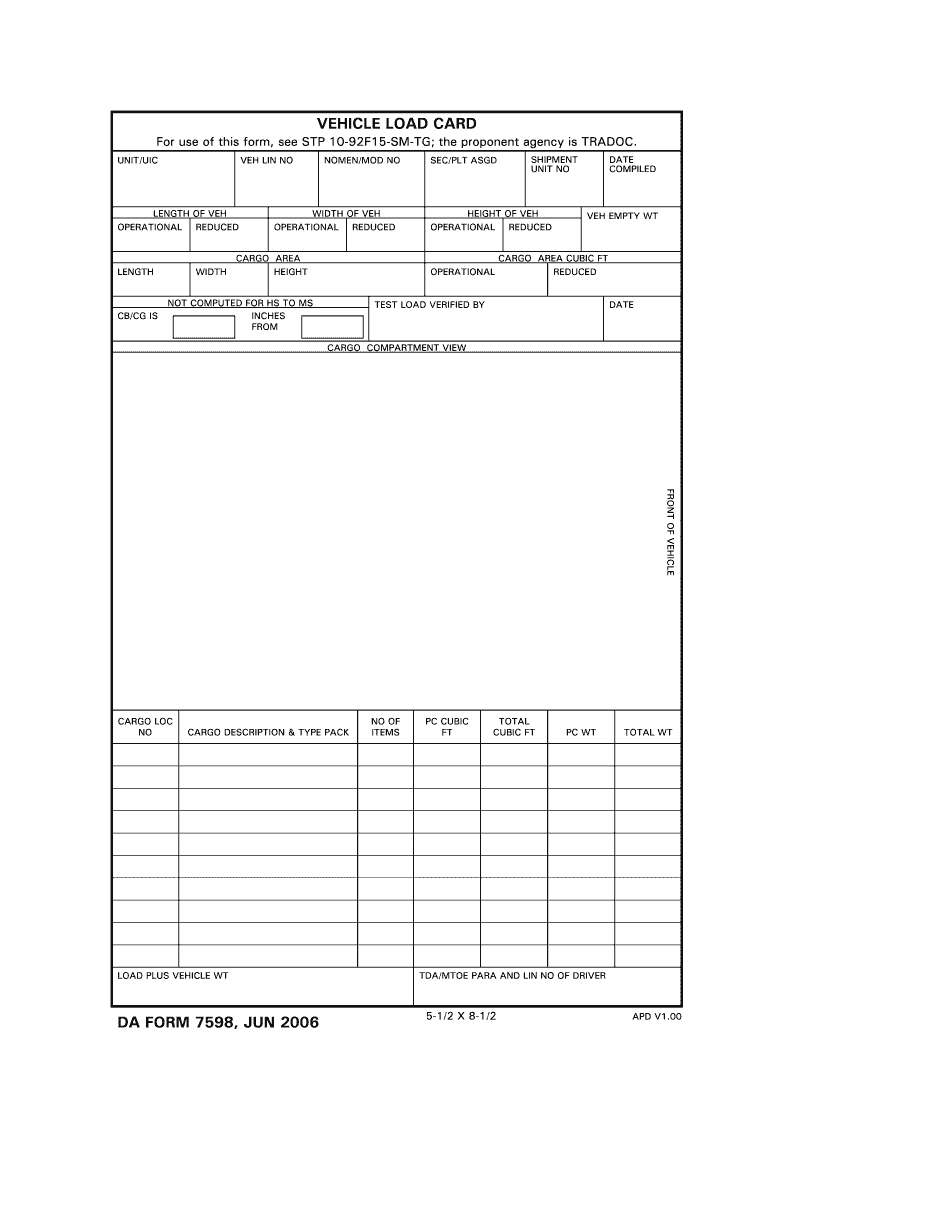

Complete or edit your da form 7598 anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export army vehicle load plan directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your army load plan form as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your da 7598 by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Da Form 7598

About Da Form 7598

Da Form 7598 is a military form used in the United States Army to document and report medical readiness and individual medical equipment (IME) for soldiers. It is commonly known as the Medical Readiness Report (MRR) form. This form is required for all active duty and reserve soldiers to maintain their medical readiness, and it must be completed annually or whenever there is a change in the soldier's medical status. The MRR form documents each soldier's medical status, including their physical exam status, immunizations, dental readiness, and any medical conditions they may have. The Da Form 7598 is used by unit commanders and medical personnel to ensure that soldiers are medically fit to perform their duties, and it is an essential tool for managing the medical readiness of individual soldiers and the entire unit. It also serves as a record of the soldier's medical equipment, such as gas masks and earplugs, ensuring that they are properly equipped and able to perform their duties safely. In summary, any soldier in the United States Army is required to submit Da Form 7598 annually or as needed to maintain their medical readiness and document their individual medical equipment.

Online technologies enable you to organize your document administration and raise the productivity of your workflow. Look through the brief guide in an effort to complete Da Form 7598, prevent errors and furnish it in a timely way:

How to complete a Army Load Plan?

-

On the website hosting the form, click on Start Now and move to the editor.

-

Use the clues to complete the applicable fields.

-

Include your personal data and contact details.

-

Make sure that you enter proper information and numbers in appropriate fields.

-

Carefully check the information in the blank so as grammar and spelling.

-

Refer to Help section should you have any concerns or address our Support team.

-

Put an digital signature on the Da Form 7598 printable while using the support of Sign Tool.

-

Once the form is completed, press Done.

-

Distribute the ready document by way of electronic mail or fax, print it out or save on your device.

PDF editor makes it possible for you to make changes to your Da Form 7598 Fill Online from any internet connected gadget, customize it in accordance with your needs, sign it electronically and distribute in several ways.

What people say about us

Complex paperwork, simplified

Video instructions and help with filling out and completing Da Form 7598